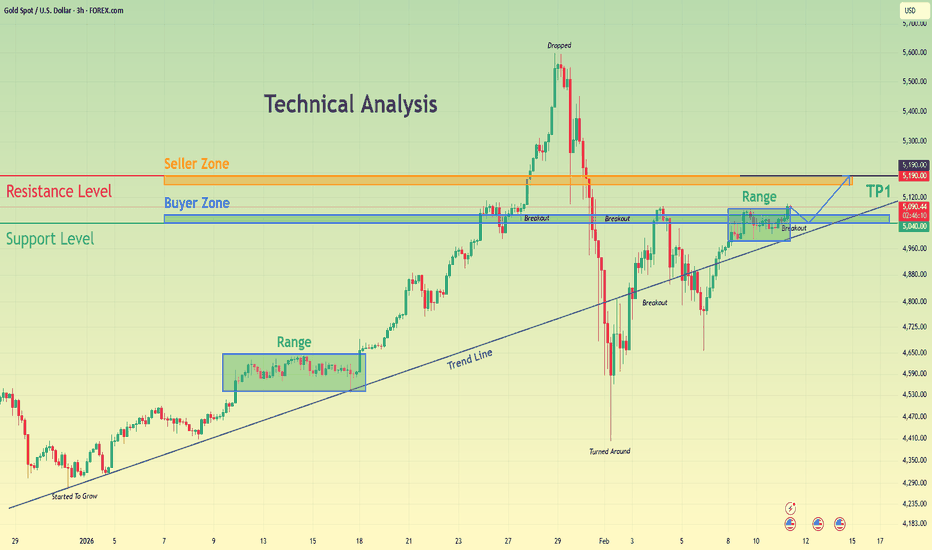

XAUUSD Builds Strength Above Demand - Next Target $5,190Hello traders! Here’s my technical outlook on XAUUSD (3H) based on the current chart structure. Gold is trading within a broader bullish market structure, supported by a well-defined rising trend line that has guided price higher over time. Earlier in the move, price entered a consolidation phase, forming a clear range where buyers and sellers were in temporary balance. This range acted as an accumulation zone before a strong impulsive breakout to the upside, confirming buyer dominance and continuation of the bullish trend. After the breakout, XAUUSD accelerated sharply and reached a major pivot high, where strong selling pressure entered the market. This led to a deep corrective drop, erasing a large portion of the prior rally. However, the decline stalled at a key support area near the trend line, where price sharply reversed — a clear sign that buyers were still defending the broader bullish structure. This reaction marked a structural “turnaround” rather than a full trend reversal. Currently, gold is consolidating again above the Buyer Zone and holding above the rising trend line. Price has formed another tight range just above support, indicating compression and absorption of supply. Multiple breakout attempts from this range suggest growing bullish pressure, while the market continues to respect the demand area below. This type of consolidation after a strong recovery often signals preparation for the next impulsive move. My primary scenario favors bullish continuation as long as price holds above the Buyer Zone and the ascending trend line. A confirmed breakout and acceptance above the current range would open the path toward the Resistance / Seller Zone around 5,190, which serves as TP1 and a key area where sellers may react. A clean break above this level would further strengthen the bullish case and signal continuation of the broader uptrend. On the other hand, a decisive breakdown below support and loss of the trend line would invalidate the bullish setup and shift focus toward a deeper corrective phase. For now, structure, trend, and price behavior continue to favor buyers. Please share this idea with your friends and click Boost 🚀

Community ideas

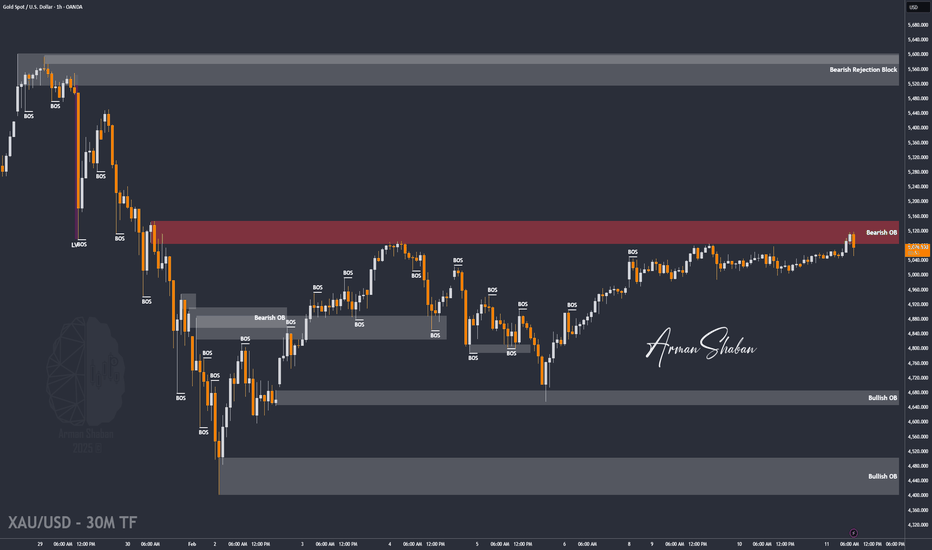

XAU/USD | Gold Breaks $5086, Now Testing Key Zones Again!By analyzing the #Gold chart on the 1-hour timeframe, we can see that after a small pullback yesterday, price made a strong move toward the $5086 resistance. Gold successfully broke this level and rallied up to $5121.

After reaching this important zone, price faced selling pressure and is now trading around $5076.

Key demand zones are $5026, $5050, and $5059.

Key supply zones are $5092–$5099 and $5111–$5121.

If Gold manages to break and hold above the $5120 zone, we can expect further upside toward $5146.

Keep a close eye on price reaction at each of these zones. This analysis will be updated soon.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

EURUSD Price Update – Clean & Clear ExplanationEUR/USD is trading within a short-term bullish structure on the 30-minute timeframe, supported by a well-respected ascending trendline that has guided price higher over the past sessions. After a strong impulsive rally, the pair entered a consolidation phase, forming higher lows while gradually pushing toward the 1.1920 resistance area.

Price is currently hovering just below a key supply zone near 1.1935–1.1940, where previous selling pressure emerged. A clean breakout and sustained move above this region could open the door for further upside continuation, extending the bullish momentum.

However, if the pair fails to break higher, a corrective pullback remains likely. Initial support is seen around 1.1890–1.1900, aligning with the rising trendline. A deeper retracement could target the 1.1860 level, with stronger support resting near 1.1820.

Overall, the bias remains cautiously bullish while price holds above the ascending trendline, but rejection from resistance could trigger a short-term correction before the next directional move.

“If you come across this post, please like, comment, and share. Thanks!”

GBPUSD - Daily CLS - Model 1 - Full Range TPHi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50% of the range take partial or full close.

I promised myself I’d become the person I once needed the most as a beginner. Below are links to a powerful lessons I shared on Tradingview. Hope it can help you avoid years of trial and error I went thru.

📊 Sharpen your trading Strategy

⚙️ 100% Mechanical System - Complete Strategy

🔁 Daily Bias – Continuation

🔄 Daily Bias – Reversal

🧱 Key Level – Order Block

📉 How to Buy Lows and Sell Highs

🎯 Dealing Range – Enter on pullbacks

💧 Liquidity – Basics to understand

🕒 Timeframe Alignments

🚫 Market Narratives – Avoid traps

🐢 Turtle Soup Master – High reward method

🧘 How to stop overcomplicating trading

🕰️ Day Trading Cheat Code – Sessions

🇬🇧 London Session Trading

🔍 SMT Divergence – Secret Smart Money signal

📐 Standard Deviations – Predict future targets

🎣 Stop Hunt Trading

💧 Liquidity Sweep Mastery

🔪 Asia Session Setups

📀 Gold Strategy

🧠 Level Up & Mindset

🛕 Monk Mode – Transition from 9–5 to full-time trading

⚠️ Trading Enemies – Habits that destroy success

🔄 Trader’s Routine – Build discipline daily

💪 Get Funded - $20 000 Monthly Plan

🧪 Winning Trading Plan

⭕ Backtesting vs Reality

🛡️ Risk Management

🏦 Risk Management for Prop Trading

📏 Risk in % or Fixed Position Size

🔐 Risk Per Trade – Keep consistency

🧪 Risk Reward vs Win Ratio

💎 Catch High Risk Reward Setups

☯️ Smart Money - Who control Markets

Adapt useful, Reject useless and add what is specifically yours.

David Perk

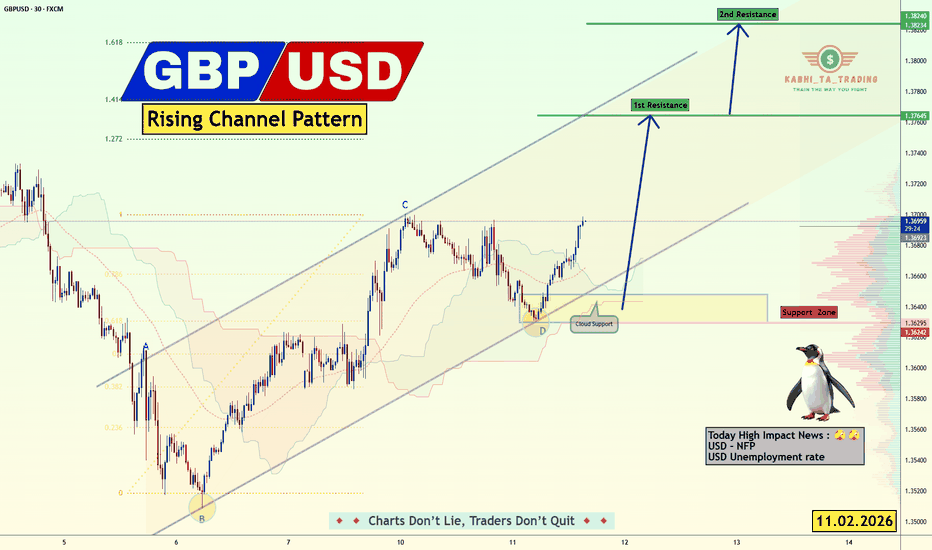

GBP/USD - Rising Channel Pattern (11.02.2026)📝 Description 🔍 Setup OANDA:GBPUSD

GBP/USD is respecting a rising channel structure, with price recently bouncing from the cloud support + channel base confluence (Point D).

Key observations:

✅Clean reaction from Fibonacci zone

✅Higher low formation inside the channel

✅Price reclaiming short-term moving average

✅Buyers stepping in at demand zone

This suggests bullish momentum is building as long as structure holds.

🟥 Support Zone: 1.3630 – 1.3620

🟩 1st Resistance: 1.3765

🟩 2nd Resistance: 1.3824

Volume profile shows strong participation near support, making it a key defense area.

#GBPUSD #Forex #PriceAction #TrendTrading #SupportResistance #Fibonacci #TradingView #SmartMoney #RiskManagement #FXTrading

⚠️ Disclaimer

This analysis is for educational purposes only, not financial advice.

Always use proper risk management and your own trading plan.

💬 Support the Idea👍 Like if you’re bullish on GBP/USD

💬 Comment: Continuation or fake breakout? 🔁 Share with fellow traders

Gold 30-Min Engaged ( Bullish Reversal Entry Detected )⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

Technical Reasons

/ Direction — LONG / Reversal 5057 Area

☄️Bullish momentum confirmed through strong candle body.

☄️Structure shifted with higher-low near key demand base.

☄️Volume expanding confirms order-flow alignment upward.

☄️Buyers reclaimed imbalance with sustained clean break.

☄️Algorithm detects rising momentum under low liquidity.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

Elise | XAUUSD · 30M – Demand Hold → Bullish ContinuationOANDA:XAUUSD

Gold swept sell-side liquidity earlier, reacted strongly from the lower demand zone, and transitioned into a controlled bullish structure. Price is now consolidating above a well-defined support base, suggesting absorption rather than distribution. As long as price holds above the demand zone, the probability favors continuation toward the higher resistance/target area.

Key Scenarios

✅ Bullish Case 🚀 → 🎯 Target: 5,180 – 5,200

❌ Bearish Case 📉 → Breakdown below 4,990 may open downside toward 4,900 → 4,850

Current Levels to Watch

Resistance 🔴: 5,180 – 5,200

Support 🟢: 4,990 – 5,000

⚠️ Disclaimer: For educational purposes only. Not financial advice.

Gold 30-Min Engaged ( Bullish & Bearish Reversal Entry Detected⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

Technical Reasons

/ Direction — LONG / Reversal 5043 Area

/ Direction — Bearish / Reversal 5105 Area

☄️Bullish momentum confirmed through strong candle body.

☄️Structure shifted with higher-low near key demand base.

☄️Volume expanding confirms order-flow alignment upward.

☄️Buyers reclaimed imbalance with sustained clean break.

☄️Algorithm detects rising momentum under low liquidity.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

Bitcoin - More blood coming! Buy 57k (extremely strong support)Bitcoin is currently in a very sharp decline, because the price dropped in the past 4 months by 53%. A lot of people didn't expect such high volatility because they are even new to the market, or they thought that ETF would reduce the overall volatility of this market. The truth is that the market is still extremely volatile, and all ETF investors may be at a massive loss on their account later in 2026, when the price drops to the all-time low of these ETFs. What is my prediction in the short term, and why will Bitcoin probably continue to go down in the next days / weeks ?

I see 2 main issues with the current price of Bitcoin. The first is that Bitcoin still didn't hit the 0.618 Fibonacci retracement of the previous bull market (2022 - 2025) - this fibo sits at 57,772 USDT. That's the first magnet. The second issue is that Bitcoin still didn't hit the parallel channel's trendline (blue descending channel on the chart). Before any pumps, I would like to see at least 1 of these 2 conditions met, so either hit the trendline or hit the 0.618 fibo.

From the Elliott Wave perspective, these are corrective types of waves, even though they are very sharp. I am still missing the last (Y) wave of the complex corrective wave (W)(X)(Y). I would also like to see a bearish divergence on the RSI indicator. The RSI indicator is oversold, but there is still no divergence, so that's another issue with what I see on the current price of Bitcoin. I am bearish, and I think Bitcoin will hit 57k in the short term. The banks and huge institutions want liquidity as much as possible before a new all-time high, so they want to take all your stop losses.

Write a comment with your altcoin + hit the like button, and I will make an analysis for you in response. Trading is not hard if you have a good coach! I am very transparent with my trades. Thank you, and I wish you successful trades!

When to Close Losers and When to Hold WinnersClosing losers and holding winners is not a mindset problem. It is a structural one. The decision should come from whether the market has invalidated your narrative or continues to support it. Emotion enters when that framework is missing.

A losing trade should be closed when the reason for the trade no longer exists. In practice, this happens when structure breaks beyond the point that defined risk. If price violates the level that anchored the setup, the market has proven a different story. Holding beyond that point turns analysis into hope. The stop is not there to protect comfort. It is there to protect logic.

Losers also need to be closed when market conditions change.

Volatility expansion, liquidity drain, or session transitions can invalidate a setup even if price has not reached the stop. If execution relied on clean participation and that participation disappears, staying in the trade increases risk without increasing probability. Capital is better preserved for conditions that support the original thesis.

Winners require a different lens. A trade should be held as long as structure continues to support the direction. Higher lows in an uptrend or lower highs in a downtrend indicate that control remains intact. Premature exits usually occur when traders focus on unrealized profit instead of structural confirmation.

Partial profit-taking can be used to reduce pressure, but full exits should align with objective signals. Momentum decay, failure to progress toward the next liquidity objective, or a clear structural break against the position are valid reasons to reduce or exit.

Another consideration is location. When price reaches major opposing liquidity or higher timeframe levels, risk increases. Holding through these areas without reassessment often leads to giving back gains. Exiting or reducing exposure here is a strategic decision, not a fear-based one.

The discipline lies in treating losses and gains symmetrically. Both decisions are governed by structure, liquidity, and environment. When trades are managed by narrative instead of emotion, losses remain controlled and winners are allowed to develop. Over time, this alignment does more for performance than any adjustment to entry technique.

SILVER XAGUSD ANALYSIS ( MUST READ IT )Hello traders

Here's my first idea about SILVER XAGUSD and what do think about it ? Kindly share your idea about SILVER XAGUSD with me in comment section

Key Points 😊

Support zone : 66.700 / 64.500

First Target 92.000

Second Target 106.000

Don't forget to share this with your friends and family and stay with us for more updates on SILVER XAGUSD

#SILVER #XAGUSD #Forex #PriceAction #TrendlineBreakout #SafeHaven #TradingView #SupportTarget #IntradayTrading #SHAY_ANALYTICS

Gold Consolidates Before NFP – What Comes Next?Gold Consolidates Before NFP – What Comes Next?

Gold has been waiting in this area for about 3 days now awaiting the NPF data.

The current area near 5080 has held the price all week, indicating the market’s reluctance to break into this area ahead of the NPF data.

The January jobs report is expected to show that payrolls rose by 70,000, up from 50,000 in December, while the unemployment rate remained stable at 4.4%.

Average earnings are expected to fall this time to 3.6% year-over-year.

1️⃣The NFP data could create a bullish move from the market price.

2️⃣A small correction before gold moves higher.

3️⃣But we cannot rule out the possibility of a deeper correction related to higher speculation before gold resumes its bullish move.

It's a bit confusing how it could go up, but I think the first 2 scenarios have the most chance.

The strength of gold has nothing to do with the NPF data. It has more to do with the geopolitical situation and the mess that Trump is creating along with his company.

IF GOLD does make an aggressive sell-off, we all need to understand that it could just be a big manipulation followed by fake news interpreting the move.

You may find more details in the chart.

Thank you and good luck! 🍀

❤️ If this analysis helps your trading day, please support it with a like or comment ❤️

EURUSD Daily CLS - Model 1 - HTF Reversal - SMTHi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50% of the range take partial or full close.

I promised myself I’d become the person I once needed the most as a beginner. Below are links to a powerful lessons I shared on Tradingview. Hope it can help you avoid years of trial and error I went thru.

📊 Sharpen your trading Strategy

⚙️ 100% Mechanical System - Complete Strategy

🔁 Daily Bias – Continuation

🔄 Daily Bias – Reversal

🧱 Key Level – Order Block

📉 How to Buy Lows and Sell Highs

🎯 Dealing Range – Enter on pullbacks

💧 Liquidity – Basics to understand

🕒 Timeframe Alignments

🚫 Market Narratives – Avoid traps

🐢 Turtle Soup Master – High reward method

🧘 How to stop overcomplicating trading

🕰️ Day Trading Cheat Code – Sessions

🇬🇧 London Session Trading

🔍 SMT Divergence – Secret Smart Money signal

📐 Standard Deviations – Predict future targets

🎣 Stop Hunt Trading

💧 Liquidity Sweep Mastery

🔪 Asia Session Setups

📀 Gold Strategy

🧠 Level Up & Mindset

🛕 Monk Mode – Transition from 9–5 to full-time trading

⚠️ Trading Enemies – Habits that destroy success

🔄 Trader’s Routine – Build discipline daily

💪 Get Funded - $20 000 Monthly Plan

🧪 Winning Trading Plan

⭕ Backtesting vs Reality

🛡️ Risk Management

🏦 Risk Management for Prop Trading

📏 Risk in % or Fixed Position Size

🔐 Risk Per Trade – Keep consistency

🧪 Risk Reward vs Win Ratio

💎 Catch High Risk Reward Setups

☯️ Smart Money - Who control Markets

Adapt useful, Reject useless and add what is specifically yours.

David Perk

GOLD(XAUUSD): Distribution Started Price Heading Towards $5400?Dear Traders,

Gold has completed accumulation phase and its now has started the distribution phase which is likely to take price to $5400 where we could see strong resistance. So use the accurate risk management while trading gold and other financial instruments.

Like and comment for more!

Team Setupsfx_

USDJPY 30Min Engaged ( Bearish & Bullish Entry Detected )⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

✈️ Technical Reasons

/ Direction — LONG / Reversal 153.110 Area

☄️Bullish momentum confirmed through strong candle body.

☄️Structure shifted with higher-low near key demand base.

☄️Volume expanding confirms order-flow alignment upward.

☄️Buyers reclaimed imbalance with sustained clean break.

☄️Algorithm detects rising momentum under low liquidity.

✈️ Technical Reasons

/ Direction — SHORT / Reversal 156.200 Area

☄️Bearish rejection confirmed through sharp candle body.

☄️Lower-high forming beneath resistance supply region.

☄️Volume decreasing confirms exhaustion in price rally.

☄️Sellers regained imbalance with heavy top rejection.

☄️Algorithm detects fading demand and shift to control.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

XAUUSD: Range Holding Strong - Upside Expansion PossibleHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD previously experienced a strong bearish impulse, breaking decisively below a key support area and triggering an acceleration to the downside. This sell-off marked a clear loss of bullish control and led to a deep corrective phase. After forming a local bottom, price began to recover and transitioned into a consolidation phase, signaling a slowdown in selling pressure. During this recovery, Gold started forming higher lows while respecting a rising triangle support line, indicating that buyers were gradually stepping back into the market. As price continued to stabilize, XAUUSD broke above the descending triangle resistance line, confirming a short-term structural shift in favor of buyers. Following this breakout, price entered a well-defined range above the support zone, showing acceptance above demand rather than an immediate rejection. Multiple breakout and retest behaviors around the support area suggest that buyers are actively defending this level. The market is now compressing within this range, reflecting absorption of supply and preparation for a potential directional move.

Currently, XAUUSD is trading above the key support zone around 5,040–5,060, while holding structure above the rising triangle support line. Price action remains constructive, with recent pullbacks appearing corrective rather than impulsive. This behavior suggests that bearish attempts are being absorbed, and buyers maintain short-term control as long as price stays above support.

My Scenario & Strategy

My primary scenario favors a bullish continuation, provided XAUUSD continues to hold above the 5,040 support zone and respects the ascending triangle support line. Consolidation above demand indicates accumulation rather than distribution. A confirmed breakout and acceptance above the current range would open the path toward the 5,180 resistance zone (TP1), which aligns with a major resistance and previous supply area. This level is expected to attract selling pressure, making it a key upside objective.

However, a decisive breakdown and acceptance below the support zone and triangle support line would invalidate the bullish scenario and signal a return of bearish pressure, potentially leading to a deeper corrective move. Until that happens, market structure and price behavior continue to favor buyers.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

ETH/USD Decision Points for Next MoveEthereum is currently exhibiting a textbook bullish reversal structure as it stabilizes within a high-confluence demand zone between $1,800 and $1,900. After a period of bearish dominance, the price action is shifting from a sequence of lower lows to a potential Market Structure Shift (MSS), evidenced by the aggressive absorption of sell orders in the current green accumulation block. The projected red path suggests a "liquidity sweep" or stop-hunt is likely—a move designed to flush out late retail shorts and hunt sell-side liquidity before the real impulsive move begins. If ETH holds this structural support, the technical setup points toward a powerful rally to retest the $2,250 resistance, with a successful breakout there confirming a medium-term trend reversal toward the $2,500 psychological level.

BTCUSDT: Bullish Scenario While Above 66.3K SupportHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT was previously trading inside a well-defined descending channel, where price consistently respected the falling resistance and support boundaries. This structure was characterized by a sequence of lower highs and lower lows, confirming sustained bearish pressure and controlled downside continuation rather than panic selling. Each corrective bounce into channel resistance was rejected, reinforcing seller dominance throughout the move lower. As price approached the Support Zone around 66,300, selling momentum began to weaken. Bitcoin briefly broke below this support, creating a fake breakdown and triggering sell-side liquidity. However, this move was quickly reclaimed, followed by a strong bullish impulse back above the support zone. This behavior signaled seller exhaustion and marked a potential short-term structural shift.

Currently, after the reclaim, BTCUSDT transitioned into a range structure between roughly 66,300 support and 69,900 resistance. This consolidation reflects temporary balance between buyers and sellers, with price holding above reclaimed demand while failing to break through resistance. Importantly, price is also respecting a rising triangle support line, indicating gradual bullish pressure building from below.

My Scenario & Strategy

My primary scenario favors bullish continuation, as long as BTCUSDT holds above the 66,300 Support Zone and continues to respect the rising triangle support line. The fake breakdown followed by strong acceptance above support suggests that the prior move down was a liquidity sweep rather than the start of a new bearish leg. Structurally, this range appears more like accumulation than distribution. The next key upside objective is the 69,900 Resistance Zone (TP1), which aligns with previous resistance and the upper boundary of the current range. A clean breakout and acceptance above this level would confirm bullish continuation and open the door for further upside expansion.

However, if price fails to hold above the support zone and breaks decisively below both the range low and the triangle support line, the bullish scenario would be invalidated, potentially leading to renewed downside continuation. Until such a breakdown occurs, pullbacks toward support are viewed as corrective rather than bearish reversal signals.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

$TAO Sitting on a Level That Has Never FailedGETTEX:TAO is sitting on a major long-term support level and this isn’t the first time.

If we look at the last three times we touched this support, we bounced strongly.

We may see some drop to form a wick below the support, just as we’ve seen in the last three instances. However, in each case, we eventually held that level and bounced from it.

RSI is near oversold, and the price extended into support.

Let’s see how the price responds from here.

DYOR, NFA

#TAO

BTC: The "Invisible Wall" at $70k (Why We Flush to $59.8k)The retail narrative is that Bitcoin is "consolidating" at $70k. The On-Chain data says Bitcoin is DISTRIBUTING . We just hit an "Invisible Sell Wall" driven by three massive structural failures. This is not a dip to buy; it is a Rational Deleveraging triggered by a $6.3B supply shock that the market cannot absorb.

1. THE ON-CHAIN REALITY (SUPPLY SHOCK) ⛏️

• Miner Capitulation: Miners transferred 90,000 BTC ($6.3B) to exchanges in the last 72 hours.

• Historic Magnitude: This is the largest miner sell-off since 2024, signaling they are selling to survive as margins tighten.

• The Impact: Spot demand cannot absorb $6.3B in selling pressure without a significant repricing event. The "Wall" is real.

2. THE MACRO & STRUCTURE 📉

Bearish Triggers:

• Yield Spike: US 10-Year Treasury Yields spiked to 4.17% . When risk-free rates rise, capital flees crypto.

• Capital Flight: While BTC is down -3%, high-beta alts (BNB, ZEC, SUI) are down -6%+, signaling a "Risk-Off" environment where liquidity exits to USD, not Alts.

• Broken Support: We lost the 200-Week EMA at ~$68,000, a major secular bull/bear line.

The Conflict:

Retail is waiting for "Alt Season" while Institutions are executing a "Flight to Safety." The divergence between the Miner Sell Wall and retail hope creates a trap at $66k.

3. THE TRADE SETUP 🎯

🔴 Scenario A: The Rational Deleveraging

• Trigger: Rejection at $67,500 - $68,000 (Retest of broken 200W EMA support)

• Entry: $67,500 zone (selling into the Miner Wall)

• Target 1: $62,000 (October Support Cluster)

• Target 2: $59,800 (The "Weak Low" Liquidity Sweep)

• Stop: 4H close above $70,500 (Invalidates the Miner Capitulation thesis)

🟢 Scenario B: The Reclaim (Low Probability)

• Trigger: Daily close back above $70,000

• Context: Requires Miners to stop selling and Coinbase Premium to flip positive

• Target: $74,000 range high

MY VERDICT

The "Miner Wall" is too heavy. The market needs to clear the leverage at $59,800 before the bull run can resume. I am positioning SHORT into any relief rally near $67.6k. Confidence: 75% Bearish

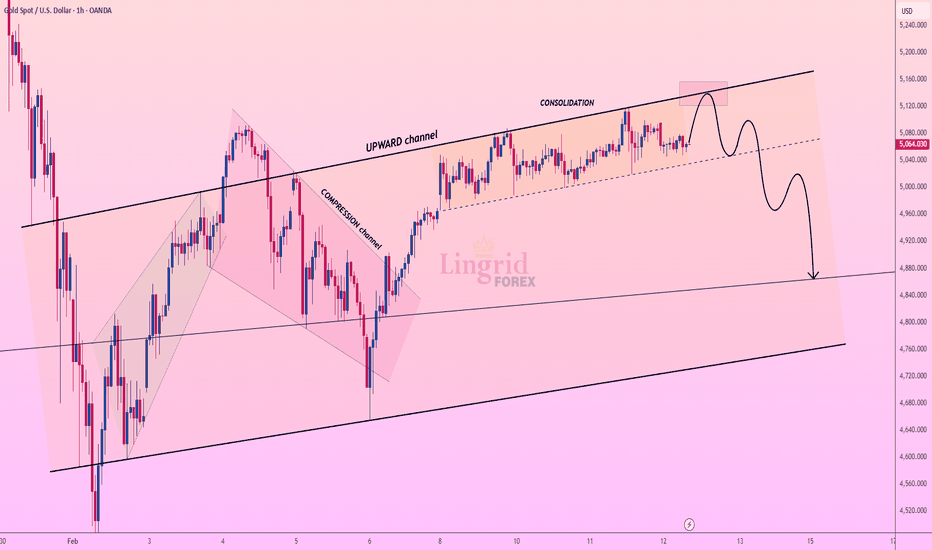

Lingrid | GOLD Weakening Price Action Suggests ExhaustionOANDA:XAUUSD has been respecting the upward channel, but recent price action shows signs of exhaustion as the market approaches the upper boundary of the channel. The recent rally has failed to break through the key resistance zone, forming a lower high. This suggests that the bullish momentum is weakening, and sellers may begin to take control. A pullback is likely as the market tests support near the bottom of the channel.

If sellers step in at the resistance zone above 5,100, price could fall back toward lower levels, potentially reaching the 4,880 support area. This could lead to further downside movement if the lower support fails to hold.

➡️ Primary scenario: rejection at 5,100 → pullback to 4,880 support.

⚠️ Risk scenario: a clean breakout above channel would invalidate the bearish bias and could lead to a test of higher resistance at 5,200.

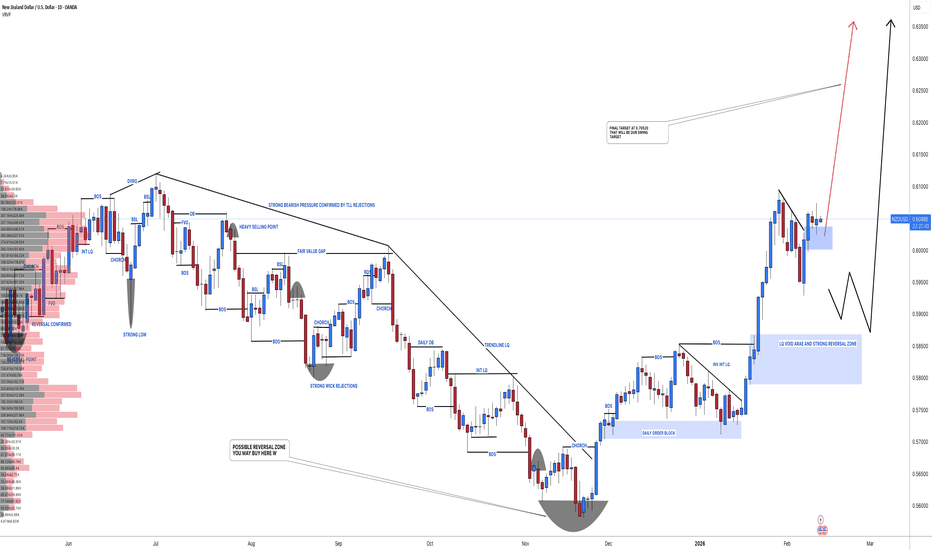

#NZDUSD:+1050 Pips Possible Intraday+Swing Buying OpportunityDear traders,

We have a great opportunity with NZDUSD. The price could hit 0.7050 soon. There are two buying options:

1. **Risky Option:** Buy at the red line marked with a blue zone. This is a risky zone but the current price momentum suggests it could work out well.

2. **Safer Option:** If the price takes out the sell-side liquidity and drops below the entry zone, it will fill the liquidity void. This area looks safe but the price could move earlier.

The target is 0.7040, which is a 1050 pips gain. You can adjust your take profit based on your risk management. Remember, this is a swing analysis mixed with intraday viewpoint so be prepared to hold the trade for a few days.

If you like our work, please like and comment for more analyses. As always, trade safely and smartly!🧠🏆

Team SetupsFX_❤️

Gold Price Analysis – Resistance and Support LevelsThis chart highlights crucial price levels for gold, including Key Resistance Level at 5,440.457, where a breakout or price rejection may occur. The Minor Resistance at 5,112.237 could lead to a potential reversal. The Support Zone around 5,062.548 is being tested, with the expectation for price stabilization or a potential bounce. Critical Support at 4,980.486 is a key level for a possible bullish reversal, while Major Support at 4,704.862 could provide strong reversal potential. Extreme Support at 4,500.854 is identified as a significant reversal zone, where price is likely to find strong support and could trigger a sharp bullish recovery.